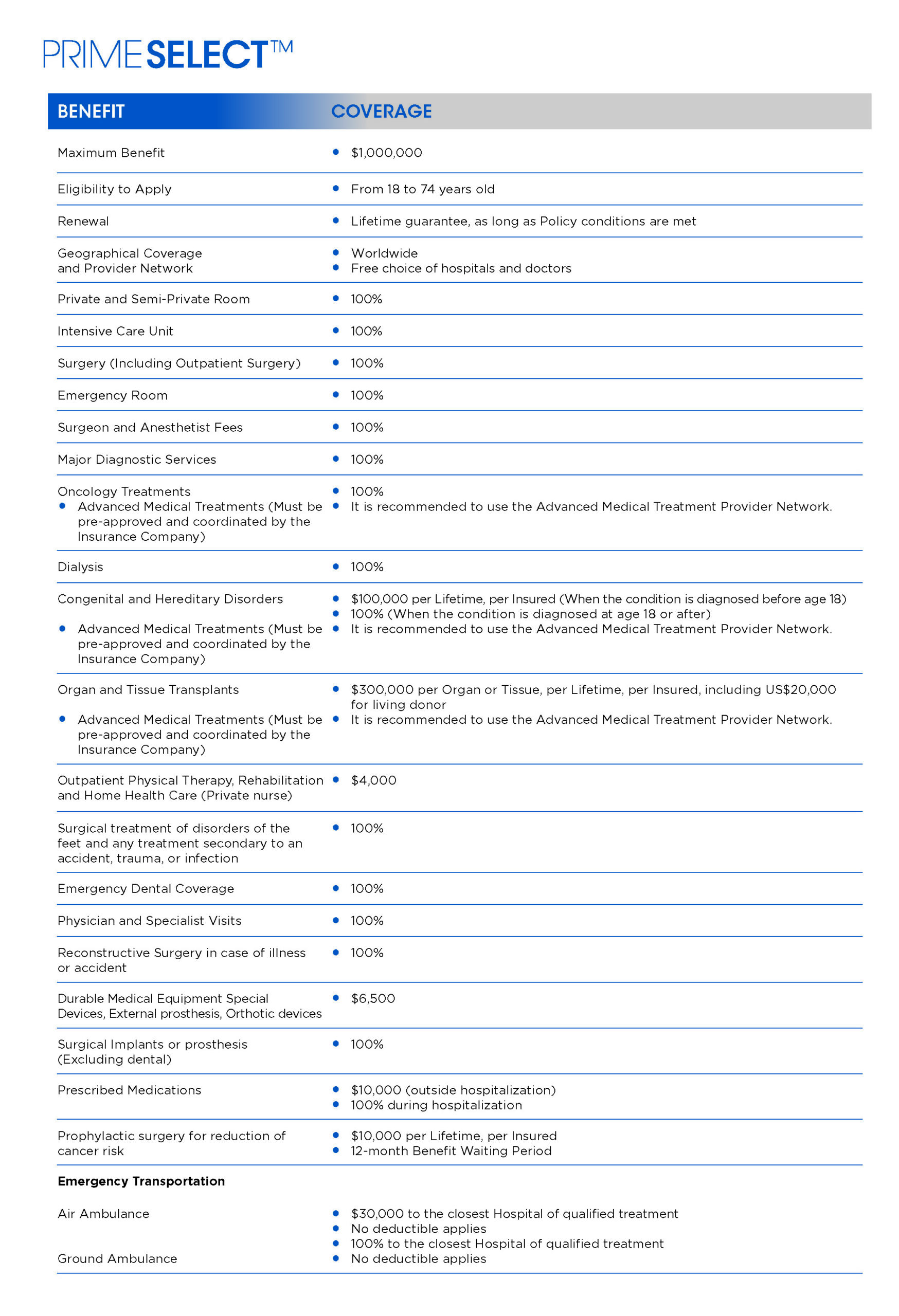

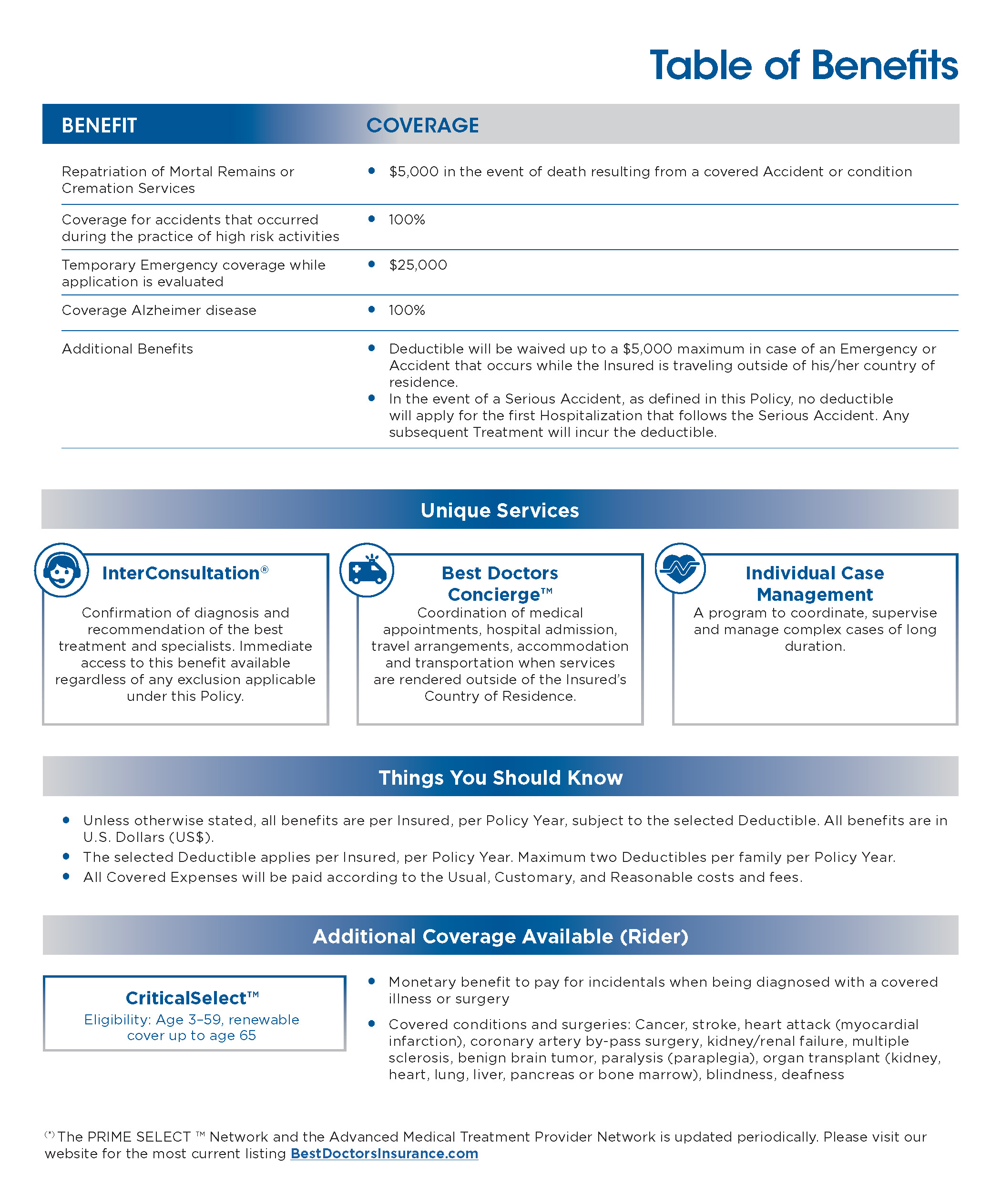

PRIME SELECT™

All Health Plans

- MEDICAL ELITE™

- PREMIER PLUS™

- PREMIER CARE™

- GLOBAL CARE™

- MEDICAL CARE™

- MEDICAL CARE™ INTERNATIONAL

- MEDICAL SELECT™

- MEDICAL SELECT ™ INTERNATIONAL

- ULTIMATE CARE™

- PRIME SELECT™

- PREMIER CARE™ CHILE

- MEDICAL ELITE™ BRAZIL

- MEDICAL ELITE™ NET BRAZIL

- PREMIER PLUS™ BRAZIL

- PREMIER PLUS™ NET BRAZIL

- GLOBAL CARE™ BRAZIL

- GLOBAL CARE™ PREFERRED BRAZIL

- GLOBAL CARE™ PRIME BRAZIL

- GLOBAL CARE™ SECURITY BRAZIL

- MY CHOICE™ BRAZIL

- MY CHOICE™ NET BRAZIL

- MEDICAL SELECT™ BRAZIL

- MEDICAL SELECT™ NET BRAZIL

- MEDICAL SELECT™ MEXICO

At Best Doctors Insurance, we are proud to help our members enjoy better and healthier lives

- Office hours: 9 a.m. – 5 p.m. EST

- Customer Service hours: 9 a.m. – 6 p.m. EST

Toll Free Numbers

- U.S. collect call: 1.305.269.2521

- U.S. toll free: 1.866.902.7775

- Fax: 1.800.476.1160

- Ecuador: +593.4.400.8000

- Venezuela: +58.212.720.2102

- Madrid: +34.900.839.034

- Chile: +56.225.95.2882

- Mexico: +52.55.554.169.7210

- Peru: +51.1705.9741

- Brazil: 0.800.878.4070

- Trinidad & Tobago: 1.888.826.9630

©2024 Best Doctors Insurance. All Rights Reserved. Privacy Policy & Terms and Conditions